Maximizing Home Purchase Potential: Local Mortgage Program Insights for Agents

Discover game-changing mortgage insights to effortlessly guide clients through the daunting process of financing their dream home.

Are you a local real estate agent looking to help your clients maximize their home purchase potential? As a well-informed and competent mortgage loan officer, I'm here to provide insights into local mortgage programs that can benefit both you and your clients. In today's competitive real estate market, having a deep understanding of mortgage programs can give you a distinct advantage in helping your clients find and finance their dream homes.

Local mortgage programs can offer unique opportunities for homebuyers, and as a real estate agent, being aware of these programs can help you guide your clients towards options that suit their specific needs. Whether it's a first-time homebuyer program, a down payment assistance program, or a specialized loan program for certain demographics, understanding the nuances of these offerings can make a significant difference in your ability to help your clients achieve their homeownership goals.

When it comes to maximizing home purchase potential, having a strong partnership with a knowledgeable mortgage loan officer is crucial. By collaborating with a mortgage professional who has a deep understanding of local programs, you can provide your clients with valuable insights and guidance throughout the home buying process. This partnership can help you streamline the home purchase process and ensure that your clients are well-informed about their financing options.

Here are some key suggestions to help you maximize your clients' home purchase potential:

1. Build strong relationships with local mortgage loan officers who have expertise in local mortgage programs. By partnering with a knowledgeable mortgage professional, you can tap into their insights and offer your clients a comprehensive range of financing options.

2. Stay informed about the latest updates and changes in local mortgage programs. The real estate market is constantly evolving, and being up-to-date with the latest offerings can give you a competitive edge in guiding your clients towards the most suitable mortgage programs.

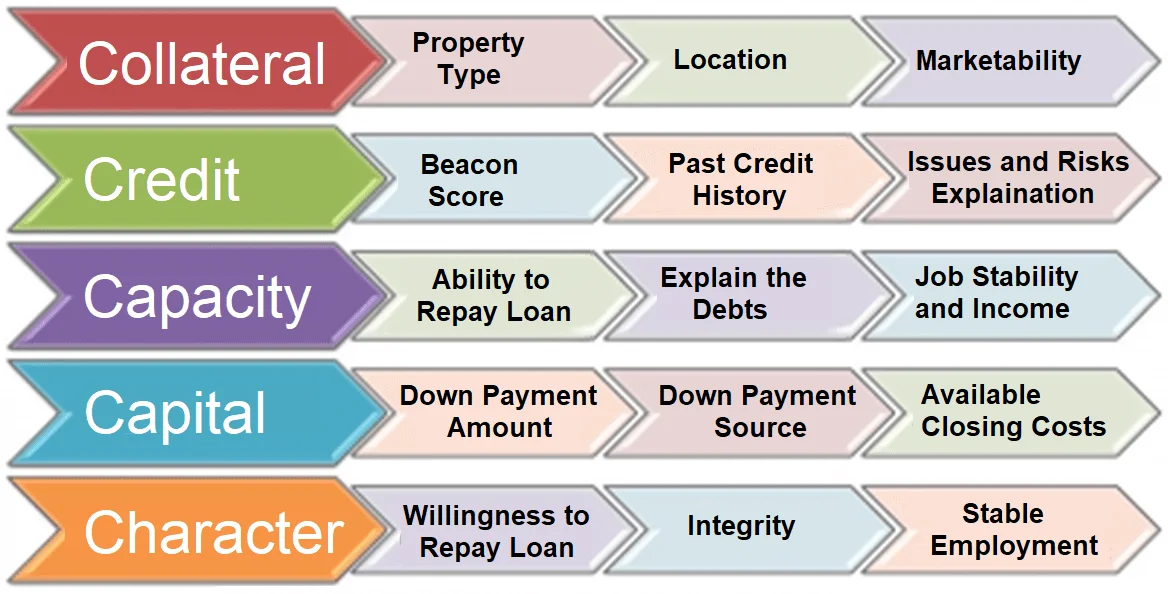

3. Understand the eligibility criteria for different local mortgage programs. By knowing the specific requirements for various programs, you can help your clients assess their eligibility and make informed decisions about their home purchase potential.

4. Encourage your clients to reach out to you to discuss their specific needs and goals. By having open and transparent communication, you can gain a deeper understanding of what your clients are looking for in a mortgage program, allowing you to provide tailored guidance and support.

At our customer-focused mortgage company, we are committed to providing local real estate agents with the valuable insights and expertise they need to help their clients maximize their home purchase potential. If you're looking to enhance your knowledge of local mortgage programs and build a strong partnership with a dedicated mortgage professional, we encourage you to reach out to us. Our team of well-informed loan officers is here to support you and your clients on the path to successful homeownership. Get in touch with us today to explore how we can collaborate to achieve your clients' homeownership goals.